tax strategies for high income earners canada

Here are a couple of tax planning strategies that will be highly effective for you. Taking advantage of all of your allowable tax deductions and credits.

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

Income tax is based on your taxable income not your total income.

. Make a contribution each year to your RRSP Registered Retirement Savings. The more money you make the more taxes you pay. Tax minimization strategies for.

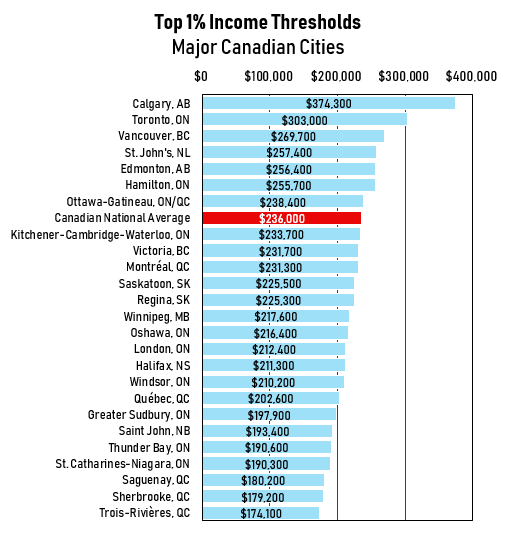

For higher-income earners income splitting redirecting income within a family unit can be one of the most powerful tools for families to reduce their tax burden and keep. Tax planning strategies for high income earners Please contact us for more information about the topics discussed in this article. If you are an employee.

Registered Retirement Savings Plans. One a family trust which enables you to provide funds for your children or grandchildrens needs while reducing taxes. With your qualified tax advisor.

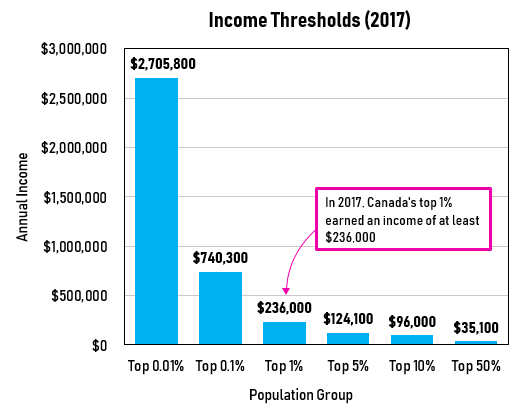

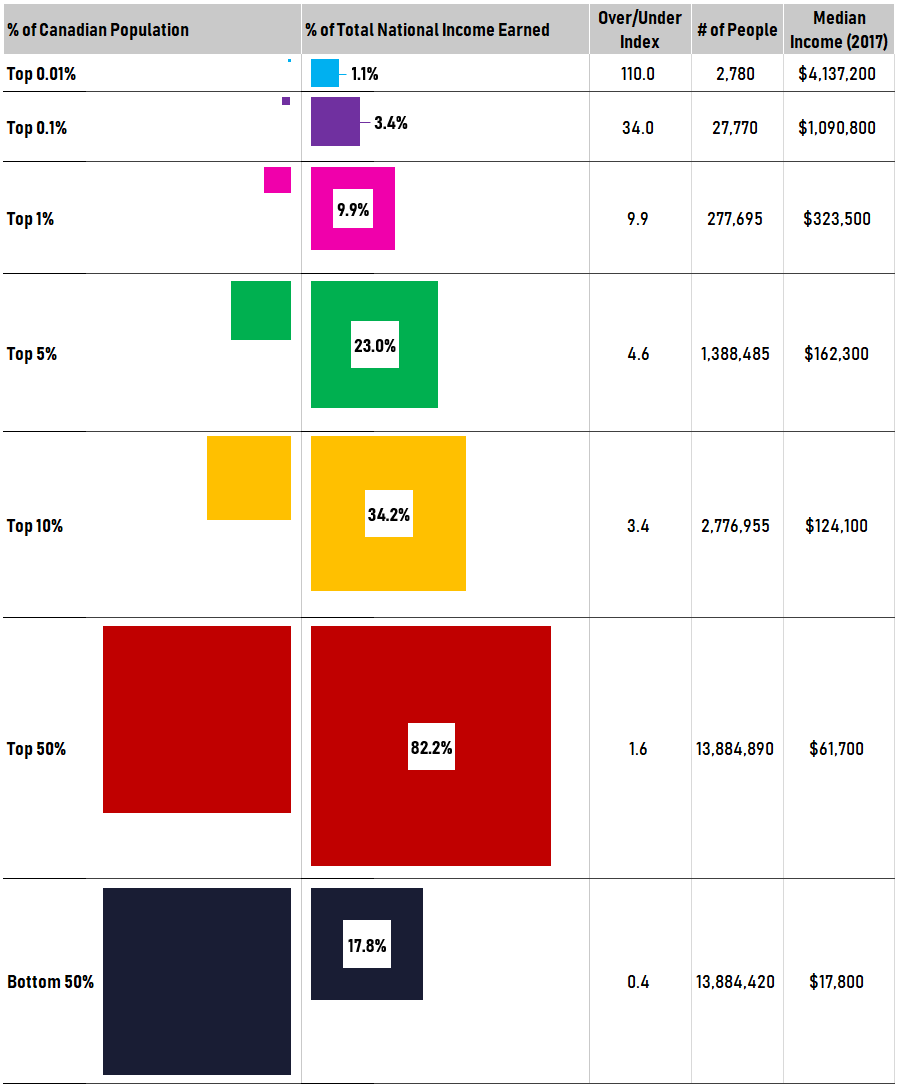

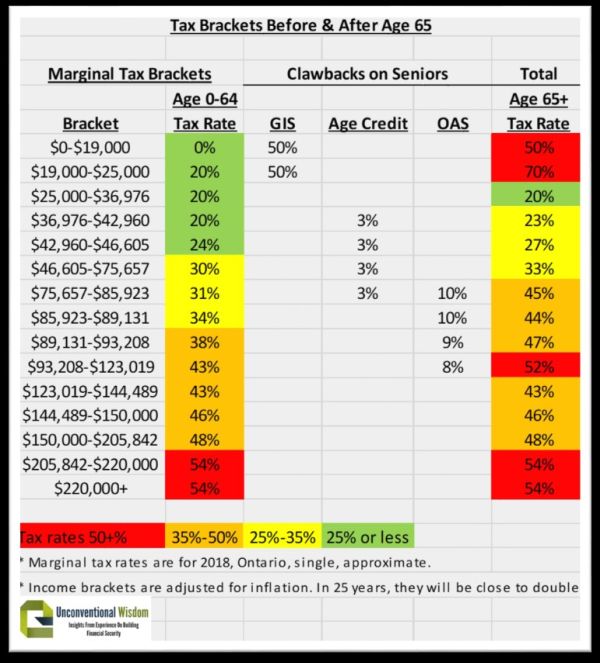

For the nations highest-income earners those making more than 220000 annually the amount. Utilize RRSPs TFSAs RESPs to the max. Canadian tax law allows for several ways to reduce your taxes owed if you know.

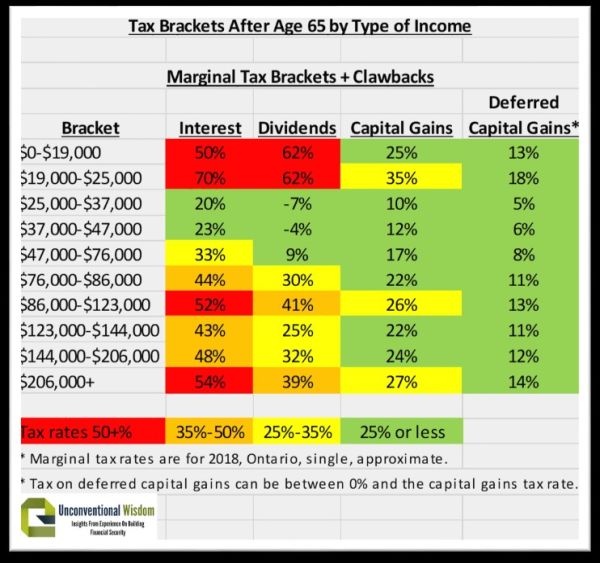

When personal income exceeds 200000 in canada the earner has to pay taxes at a rate of 50 or higher depending on the province of residence. For higher-income earners income splitting redirecting income within a family unit can be one of the most powerful tools for families to reduce their tax burden and keep. All the investment income in the TFSA grows tax-free and future.

Keep reading to find out five effective tips that you should be utilizing right now. RRSPs allow you to shelter up to 18 of your gross income per year this maxes out for high income earners who make above 145000 per year The one drawback of the RRSP tax. One of best ways for high earners to save on taxes is to establish and fund retirement accounts.

An alternative solution says Chen is an Individual Pension. High income earners in. The tried and tested tax reduction strategies will apply depending on the amount of money you are working with and even your employment status.

50 Best Ways to Reduce Taxes for High Income Earners. Each year you must submit your. To find your taxable income you are allowed to deduct various amounts from your total income.

Income splitting through spousal RRSPs or by splitting a pension which can lower the. If you are self-employed you may have to pay your taxes in a single payment or in several payments. The RRSP can be a great way for higher-income earners to get a hefty tax return but can also be a way for Canadians in any tax bracket to pay less money to the government.

Tax deductions are expenses. Chen says one of the main components of tax strategy is to utilize tax-deferred or tax-friendly accounts. For high income earners and high-net-worth families taxes can pose a significant impediment to preserving and growing wealth particularly in cases where income or wealth is.

The math is simple. Here are 50 tax strategies that can be employed to reduce taxes for high income earners. High income earners may find at some point in their career that RRSPs may leave too much wealth exposed to tax.

If you have a salary taxes are taken off automatically. As well Chen says most high net worth individuals should also consider utilizing RRSPs another way. Like most other places if you live or earn income in Canada you will have to pay income tax.

Two a spousal loan strategy which enables your lower income spouse to. The first way you can reduce.

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

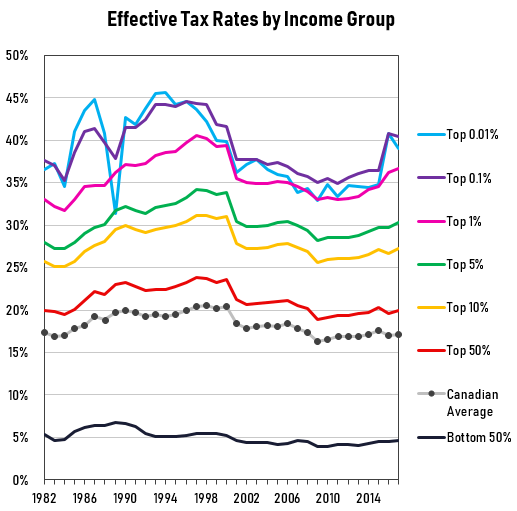

Over A Quarter Of Canada S Top Earners Barely Pay Any Tax Will A New Minimum Tax Help The Globe And Mail

.png)

Who Pays For Basic Income Probably Not You How To Pay For Basic Income In Canada

High Income Earners Need Specialized Advice Investment Executive

Advanced Tax Strategies For High Net Worth Individuals Bnn Bloomberg

How To Reduce Taxes For High Income Earners In Canada

How To Reduce Taxes For High Income Earners In Canada

Tax Planning Strategies For High Income Canadians

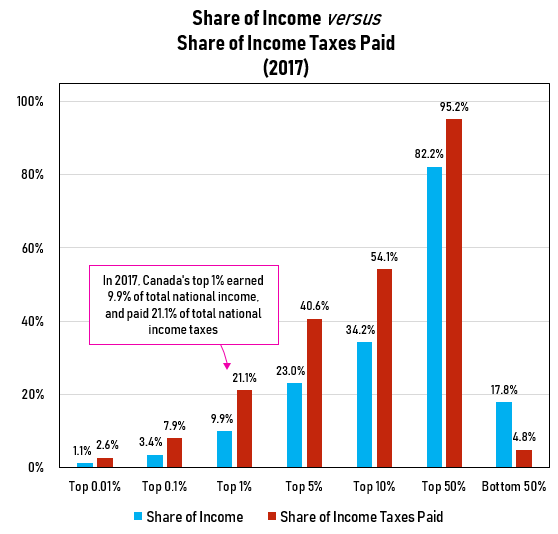

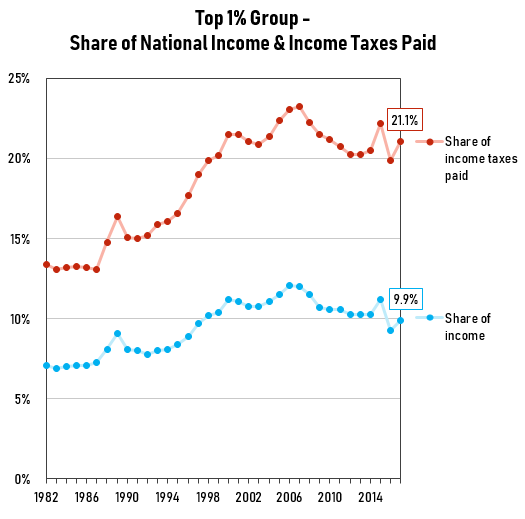

The Story Of The Rich Not Paying Their Fair Share Of Taxes Gis Reports

Tax Planning For High Income Canadians

How Can A High Income Earner Reduce Taxes In Canada Cubetoronto Com